Module 1: Introduction to QuickBooks

- Overview of QuickBooks

- Introduction to QuickBooks (Online vs Desktop versions)

- Key features and benefits

- QuickBooks Editions and Pricing

- Understanding the different versions (Pro, Premier, Online)

- Selecting the right version for your business needs

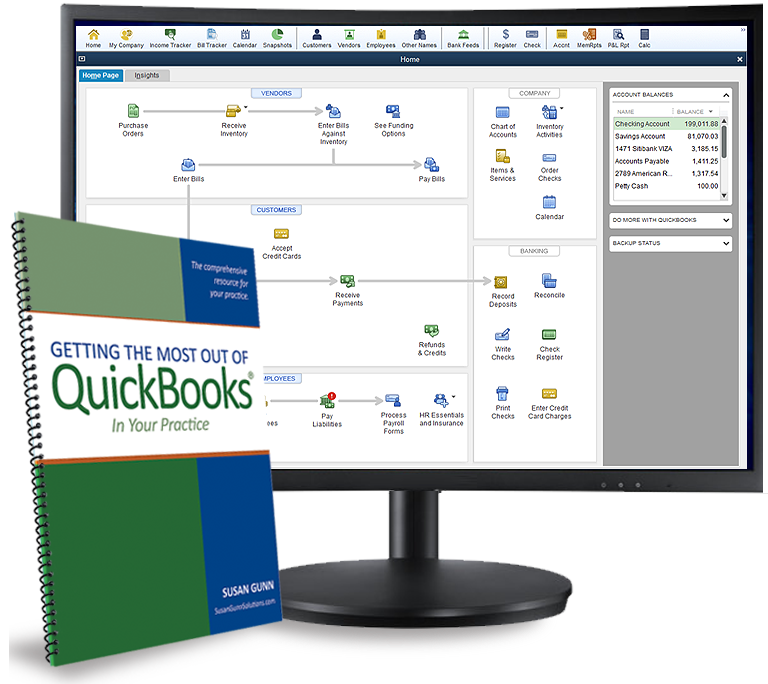

- Navigating the QuickBooks Interface

- Overview of the dashboard

- Customizing your QuickBooks workspace

- Key features in the navigation bar

Module 2: Setting Up QuickBooks for Your Business

- Setting Up a New Company

- Creating and configuring a new company file

- Entering business details (name, address, industry)

- Setting up your fiscal year

- Chart of Accounts Setup

- Understanding and creating a Chart of Accounts

- Linking accounts to appropriate categories

- Managing account types (bank, expense, income, etc.)

- Preferences and Settings

- Setting up preferences (currency, invoicing, tax settings)

- Configuring sales and purchase settings

- Enabling security features (user roles and passwords)

Module 3: Managing Customers and Sales Transactions

- Creating and Managing Customers

- Adding and editing customer information

- Setting up customer types and pricing

- Sales Transactions

- Creating and managing invoices

- Processing sales receipts and payments

- Recording refunds and credit memos

- Setting up recurring invoices

- Managing Sales Taxes

- Setting up sales tax

- Applying sales tax to transactions

- Generating sales tax reports

Module 4: Managing Vendors and Purchase Transactions

- Creating and Managing Vendors

- Adding vendor information (suppliers, contractors)

- Setting up payment terms

- Purchase Orders and Invoices

- Creating purchase orders

- Recording bills and vendor payments

- Handling purchase returns and credits

- Managing Accounts Payable

- Paying bills and managing expenses

- Setting up recurring expenses

- Running Accounts Payable reports

Module 5: Bank Reconciliation and Cash Flow Management

- Setting Up Bank Accounts

- Adding and configuring bank accounts

- Linking bank feeds to QuickBooks

- Bank Reconciliation

- Reconciliation process (matching transactions with bank statements)

- Handling discrepancies and errors

- Running bank reconciliation reports

- Cash Flow Management

- Tracking and analyzing cash flow

- Forecasting cash flow for the business

- Generating cash flow reports

Module 6: Managing Inventory

- Setting Up Inventory

- Adding inventory items and categories

- Managing stock levels and pricing

- Tracking Inventory Sales and Purchases

- Recording inventory transactions (sales, purchases)

- Managing inventory adjustments and write-offs

- Inventory Reporting

- Running inventory reports (sales, stock levels, etc.)

- Analyzing inventory turnover and profitability

Module 7: Payroll Management

- Setting Up Payroll

- Adding employees and contractors

- Configuring payroll settings (pay frequency, deductions)

- Processing Payroll

- Running payroll (salary, hourly, commissions)

- Generating payslips and pay stubs

- Managing Payroll Taxes

- Setting up tax rates and deductions (e.g., income tax, social security)

- Filing payroll tax reports (e.g., 941, state taxes)

- Payroll Reporting

- Running payroll reports

- Managing year-end payroll (W-2s, 1099s)

Module 8: Financial Reporting and Analysis

- Generating Key Financial Reports

- Profit and Loss (Income Statement)

- Balance Sheet

- Cash Flow Statement

- Trial Balance

- Customizing Reports

- Customizing filters and date ranges for reports

- Creating and saving custom reports

- Analyzing Financial Performance

- Financial ratio analysis (liquidity, profitability)

- Generating financial performance reports for decision-making

Module 9: Tax Filing and Compliance

- Understanding QuickBooks Tax Features

- Setting up tax rates (sales tax, VAT)

- Tax settings for business types

- Generating Tax Reports

- Sales tax reports and filing

- Preparing year-end tax reports

- E-filing Tax Returns (for QuickBooks Online)

- Submitting taxes through QuickBooks Online

- Generating and filing 1099 forms for contractors

Module 10: Year-End Procedures and Closing the Books

- Preparing for Year-End

- Running year-end reports

- Finalizing income and expense entries

- Closing the Books for the Year

- Closing period functionality

- Creating closing journal entries

- Preparing for the New Fiscal Year

- Creating a new fiscal year file

- Carrying over balances and starting fresh

- Adjusting opening balances